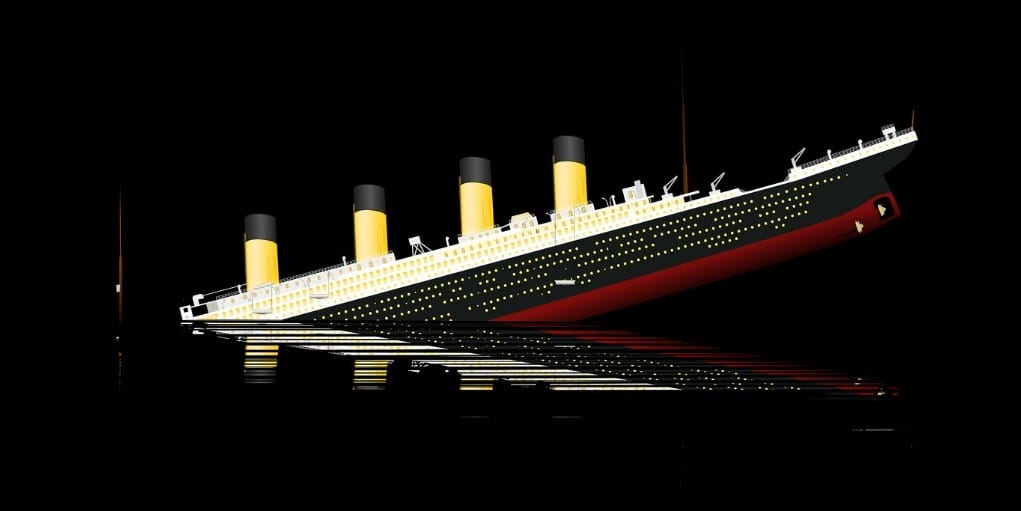

Opinion: The next debt crisis is lurking in plain sight

WASHINGTON (Project Syndicate) — When Russian tanks rolled into Ukraine, private debt crises were likely already simmering, albeit unseen, in many parts of the world due to the economic disruption caused by the COVID-19 pandemic. . Today, war is pushing even more countries into similar crises.

The pandemic recovery has always been uneven. According to an analysis based on the International Monetary Fund’s latest World Economic Outlook, per capita income hit a new high in nearly 37% of advanced economies in 2021. This share drops to around 27% in low-income countries. middle and less than 21% in low-income countries. -income countries. And these disparities may be about to widen.

Debt moratoriums

At the start of the pandemic, many countries introduced debt moratoriums, to give households and businesses a break at a time when many were facing a sharp drop in income that made it difficult for them to meet their obligations.

The moratoriums were often accompanied by policies that gave banks the regulatory flexibility not to reclassify affected loans to a higher risk category, as is generally required, thereby allowing banks to avoid higher capital provisioning than a reclassification would entail. Policymakers hoped banks would use available cash to continue lending.

But while the moratoria provided temporary relief to private debtors and may have limited the fallout from the early disruption of the pandemic, they were not without drawbacks. In particular, forbearance policies have made it harder for banking supervisors to detect early signs of rising defaults, leading to a hidden, but potentially disastrous, problem of non-performing loans (NPLs). ).

With emergency moratoriums now ending in many countries, vulnerable households and businesses, especially small and medium enterprises, are facing loan repayments they can no longer afford. This threatens to lead to a wave of defaults, with far-reaching implications for economic recovery, especially in low- and middle-income countries that are already struggling to revive growth.

Denial

There is still time to limit the damage.

But it will require both private and public sector actors to recognize the problem before it erupts into a full-blown crisis and manage it effectively. And so far, there seems to be little appetite for the kind of transparency that would require. In fact, according to data that financial institutions have provided to the IMF, there is no problem: NPL rates have remained stable between 2019 and 2020 in a large sample of advanced and emerging economies that have adopted policies of ‘abstention.

Data from the Mastercard Economics Institute, which covers 165 countries, also tells a very different story, with permanent business bankruptcies increasing nearly 60% in 2020 from their pre-pandemic (2019) baseline. Although the situation improved in 2021, around 15% of countries, mostly low- and middle-income, still recorded an increase in permanent business bankruptcies.

The World Bank’s Pulse Enterprise Survey, which covers 24 low- and middle-income countries, presents a similarly troubled picture. As shown in the graph above, in January 2021, 40% of companies surveyed expected to be in arrears within six months, including over 70% of companies in Nepal and the Philippines and over 60% of companies in Turkey and South Africa.

Credit crunch

As more and more governments unwind debt moratoriums, the risks will only grow. If the past is any guide, rising NPLs will lead to less new lending as financial institutions try to avoid exceeding their capital provisioning limits and become more risk averse. A credit crunch would not only hamper the economic recovery; it would also exacerbate inequality by disproportionately affecting lending to low-income communities and small businesses.

When one or more systemically important lenders run out of capital to cover their losses, the government may have to step in to recapitalize them. It could simply mean shifting the solvency problem to the public sector at a time when governments are already facing heavy debt burdens and stretched budgets.

Russia’s war on Ukraine is adding to the risks by intensifying inflationary pressures and undermining the recovery in many emerging market economies. The impact of the war is particularly acute in Central Asia, where banks are heavily exposed to Russian financial institutions and connected to each other via large flows of cross-border remittances. New capital and exchange controls also create risks for financial institutions.

Steps to follow

It is time to recognize and resolve this hidden crisis. The World Bank’s World Development Report 2022 outlines concrete steps policymakers can take. First, countries need to increase the transparency of financial sector balance sheets. Clear and consistent practices for reporting asset quality, backed by effective oversight, are essential. Financial institutions also need to develop their capacity to manage NPLs, so that an increase in defaults does not prevent them from continuing to lend.

Countries should also establish or strengthen legal insolvency mechanisms, including hybrid out-of-court options involving conciliation and mediation arrangements. Such systems, which are currently lacking in many emerging and developing countries, can accelerate the resolution of over-indebtedness and limit the damage caused to the financial sector. Accessible and inexpensive debt resolution procedures that reduce the involvement of the courts in restructuring are particularly important for micro, small and medium-sized enterprises, as well as for entrepreneurs and individuals.

Finally, regulators and lenders must ensure that households and businesses retain access to credit. An exceptionally uncertain economic environment, combined with a lack of transparency on the financial situation of borrowers, has increased risks and reduced the effectiveness of traditional methods of measuring them. Lenders must explore new technological approaches to risk management and lending, made possible by revised government regulations that both support innovation and ensure effective consumer and market protection.

Experience has shown that loan quality issues do not resolve themselves; if not resolved in a timely manner, the problems continue to escalate, leading to higher costs for the financial system and the real economy. If we ignore this lesson, the hidden problem of the NPL will soon become impossible to ignore.

Carmen M. Reinhart is Chief Economist of the World Bank Group.

Leora Klapper is Lead Economist in the Finance and Private Sector Research Team of the World Bank’s Development Research Group.

This commentary is courtesy of Project Syndicate—Private debt risks lurk in plain sight

![[Press release] Debt crisis: a failed G20 summit](https://www.cadtm.org/local/cache-vignettes/L710xH373/f0bd231bf33e0619051e008da75a42-274d7.jpg)